what is maryland earned income credit

Ranges from 25 to 45 percent of federal. EITC Information in Spanish.

New 2022 Maryland Tax Relief Legislation Passed Sc H Group

Find out what to do.

. Earned income includes all the taxable income and wages you get from working for someone else yourself or from a business or farm you own. Maryland Earned Income Tax Credit EITC Marylands EITC is a credit for certain taxpayers who have income and have worked. Earned Income Tax Credit.

Similar to federal stimulus payments no application for relief is necessary. You can elect to use your 2019 earned income to figure your 2021 earned income credit EIC if your 2019 earned income is more than your 2021 earned income. Some taxpayers may even qualify for a refundable Maryland EITC.

Credit is actually money back on your tax bill. It is different from a tax deduction which reduces the amount of income that your tax is calculated on. The bills purpose is to expand the numbers of taxpayers to whom the Earned Income Credit EIC is available and to provide for a new Maryland Child Tax Credit.

The local EITC reduces the amount of county tax you owe. To qualify for the EITC you must. It helps reduce the amount owed on taxes and can even result in a refund.

Common EITC Questions and Answers. If you qualify you can use the credit to reduce the taxes you owe and maybe increase your refund. States and Local Governments with Earned Income Tax Credit States and Local Governments with Earned Income Tax Credit More In Credits Deductions.

The Earned Income Tax Credit EITC is a refundable tax credit for people who worked in 2021. The state EITC reduces the amount of Maryland tax you owe. DIRECT STIMULUS PAYMENTS FOR LOW TO MODERATE-INCOME MARYLANDERS This relief begins with immediate payments of 500 for families and 300 for individuals who filed for the Earned Income Tax Credit.

If you qualify for the federal earned income tax credit also qualify for the Maryland earned income tax credit. An expansion of Marylands Earned Income Tax Credit passed quietly into law when Gov. The maximum federal credit is 6728.

The EIC is designed primarily to benefit families. R allowed the bill to take effect without his signature. Workers who qualify for the EIC and file a federal tax return can get back some or all of the federal income tax that was taken out of their pay during the year.

If you earn less than 57000 per year you can get free help preparing your Maryland income tax return through the CASH Campaign. The Earned Income Tax Credit EITC is a benefit for working people with low to moderate income. Thelocal EITC reduces the amount of county tax you owe.

The stimulus package nearly doubles the lump-sum payments to poor individuals and working families who qualify for the earned-income credit which last year went to 440000 of the states 32. 13 hours agoThe Earned Income Tax Credit is a boon for low-income New Yorkers putting hundreds even thousands of dollars back in their pockets each year. Thestate EITCreducesthe amount of Maryland tax you owe.

Election to use prior-year earned income. By design it is meant to benefit working families more than workers without children who qualify for the EITC credit. The Earned Income Tax Credit also called the EITC is a benefit for working people with low-to-moderate income.

Have investment income below 10000 in the tax year 2021. Though it is a federal credit it is matched by New York City and State and Mayor Eric Adams made expansion a top priority for his administration as part of his agenda to lift up struggling New Yorkers. See Worksheet 18A1 to calculate any refundable earned income tax credit.

Expansion of the Earned Income Credit SB218 was enacted under Article II Section 17b of the Maryland Constitution. Taxpayers without a qualifying child may claim 100 of the federal earned income credit or 530 whichever is less. The Earned Income Tax Credit EITC was first enacted on a temporary basis in 1975 as a.

50 of the federal credit on your Maryland return. You may claim the EITC if your income is low- to moderate. Have worked and earned income under 57414.

Some taxpayers may even qualify for a refundable Maryland EITC. Claiming the credits can reduce the tax owed and may also result in a larger refund. The Earned Income Tax Credit EIC is a federal tax benefit for low-income and moderate-income individuals who work full-time part-time or part of the year.

Marylanders would qualify for these payments who annually earn. 2021 Maryland Earned Income Tax Credit EITC Marylands EITC is a credit for certain taxpayers who have income and have worked. If you qualify for the federal earned income tax credit and claim it on your federal return you may be entitled to a Maryland earned income tax credit on the state return equal to 50 of the federal tax credit.

That group of taxpayers which. Did you receive a letter from the IRS about the EITC. The Maryland earned income tax credit EITC will either reduce or eliminate.

In some cases the EIC can be greater than your total income tax bill providing an income tax refund to families that may have little or no income tax withheld from. Log Out If you qualify for the federal earned income tax credit and claim it on your federal return you may be entitled to a Maryland earned income tax credit on the state return equal to 50 of the federal tax credit. The Earned Income Tax Credit EITC helps low- to moderate-income workers and families get a tax break.

Calculate your federal EITC. The Earned Income Tax Credit also known as EITC or EIC is a benefit designed to support low- to moderate-income working people. Updated on 4152021 to include changes for Relief Act 2021.

Have a valid Social Security number by the due date of your 2021 return including extensions Be a US. Marylanders who made 57000 or less in 2020 may qualify for both the federal and state Earned Income Tax Credits as well as free tax preparation by the CASH Campaign of Maryland. Does Maryland offer a state Earned Income Tax Credit.

Eligibility and credit amount depends on your income family size and other factors. Senate Bill 218 extends the tax credit to people who pay taxes using Individual Taxpayer Identification Numbers ITINs for the 2020 2021 and 2022 tax years. The credit is equal to 50 of the federal tax credit.

Maryland Student Loan Forgiveness Programs

Maryland State 2022 Taxes Forbes Advisor

Revised Maryland Individual Tax Forms Are Ready

Gop Primary In Md S 8th District 4 Moderates And A Conservative The Washington Post

Comptroller Of Maryland April 15 2020 Is Not Tax Day In Maryland Facebook

Maryland Refundwhere S My Refund Maryland H R Block

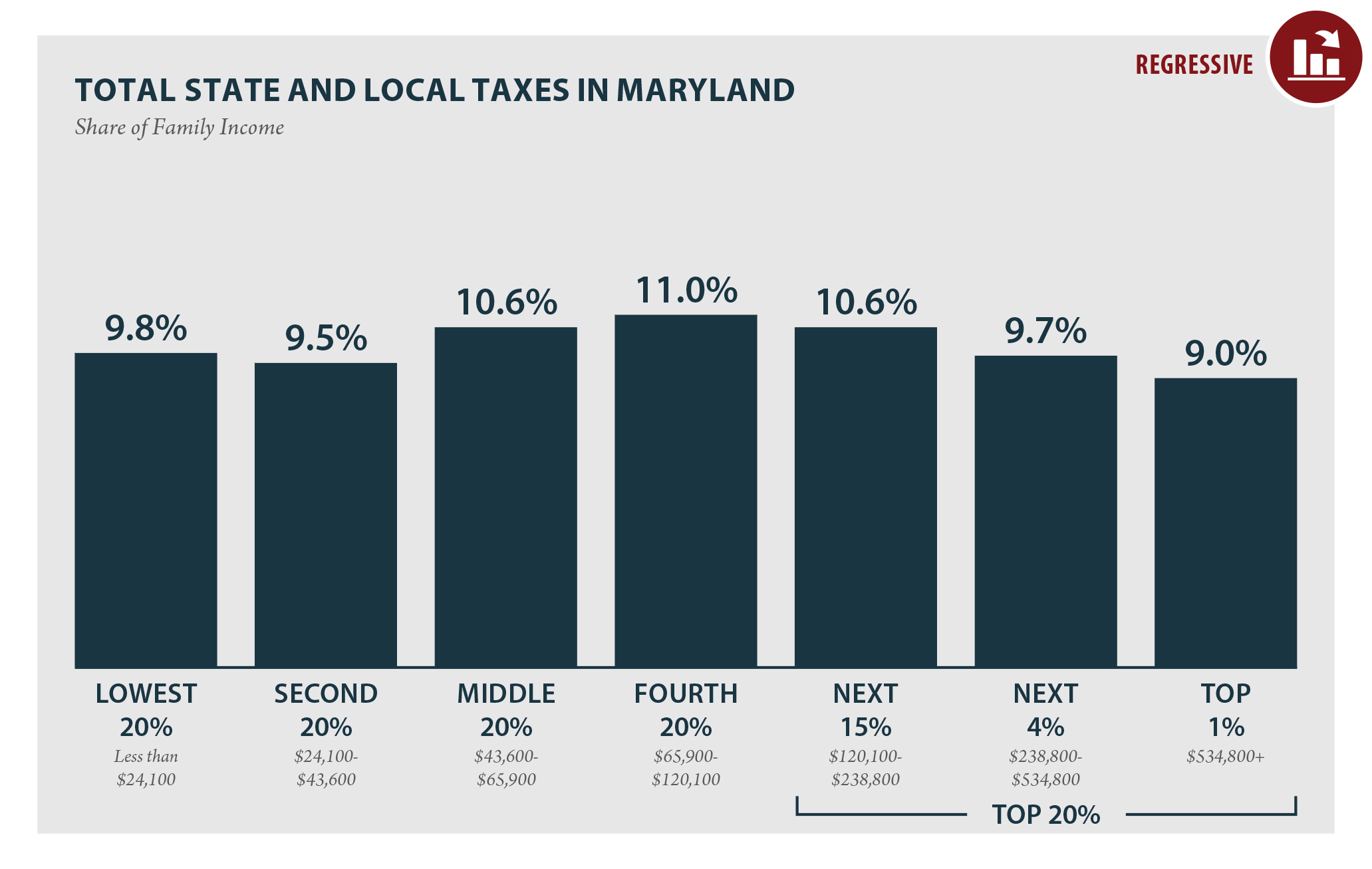

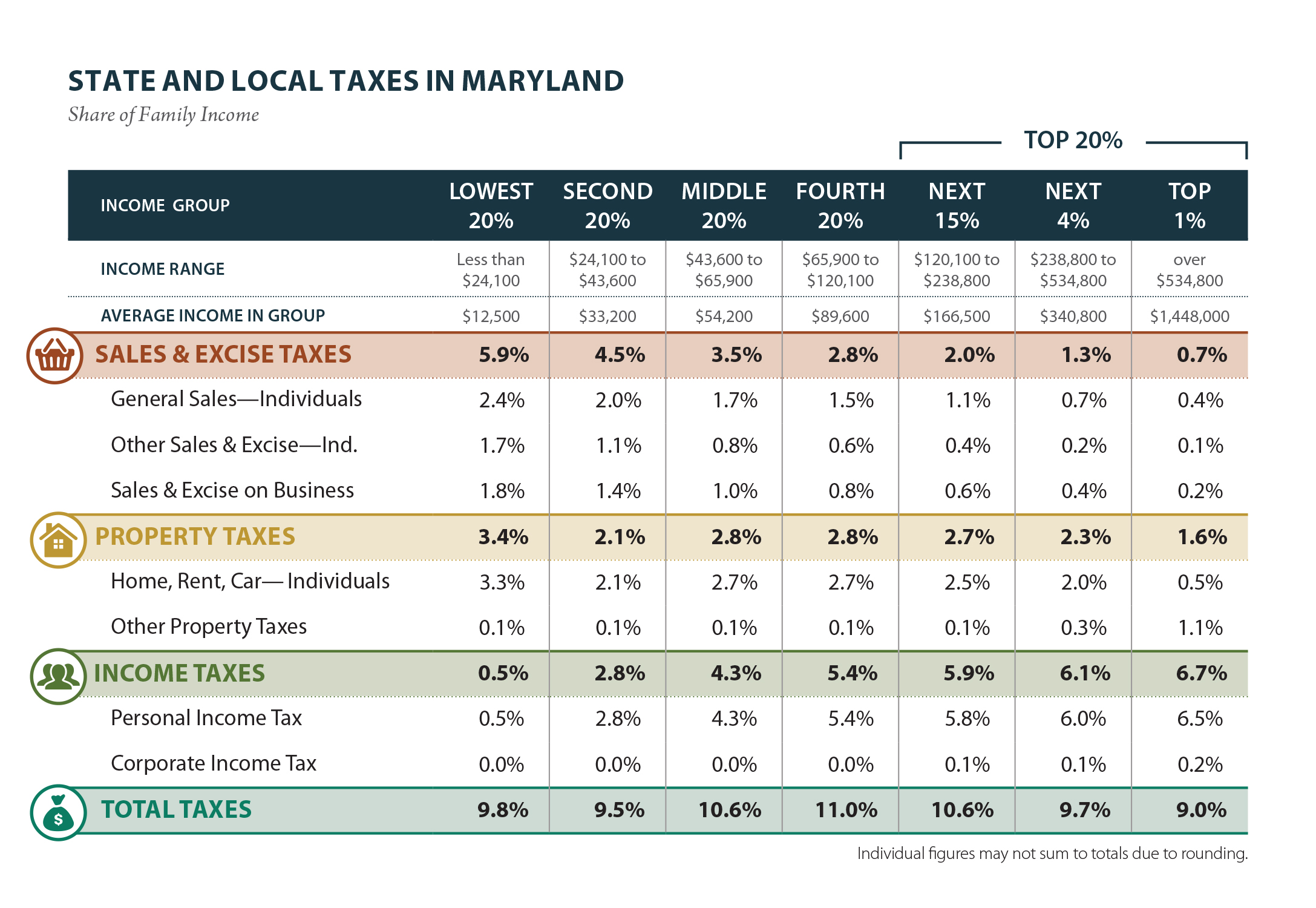

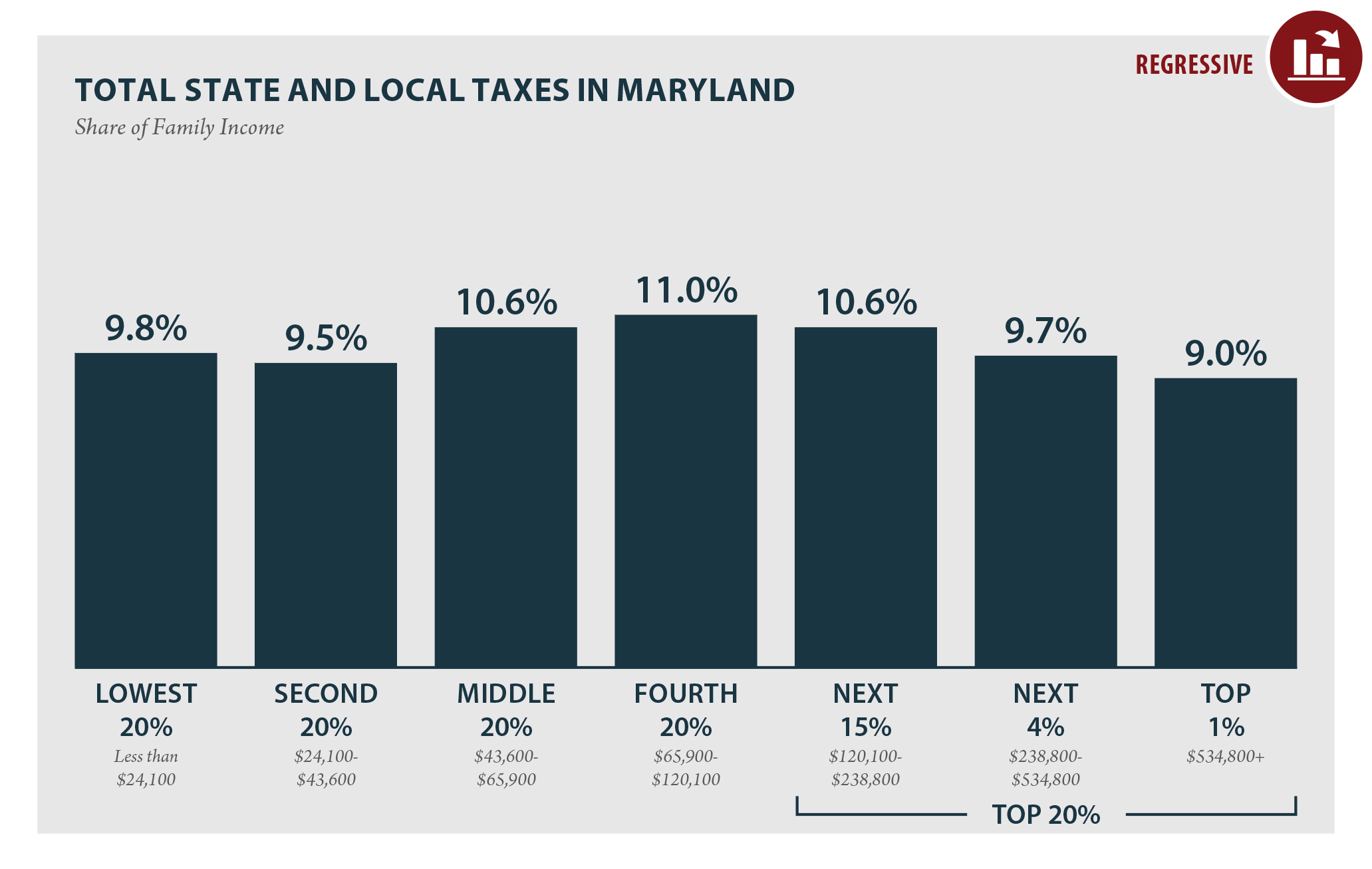

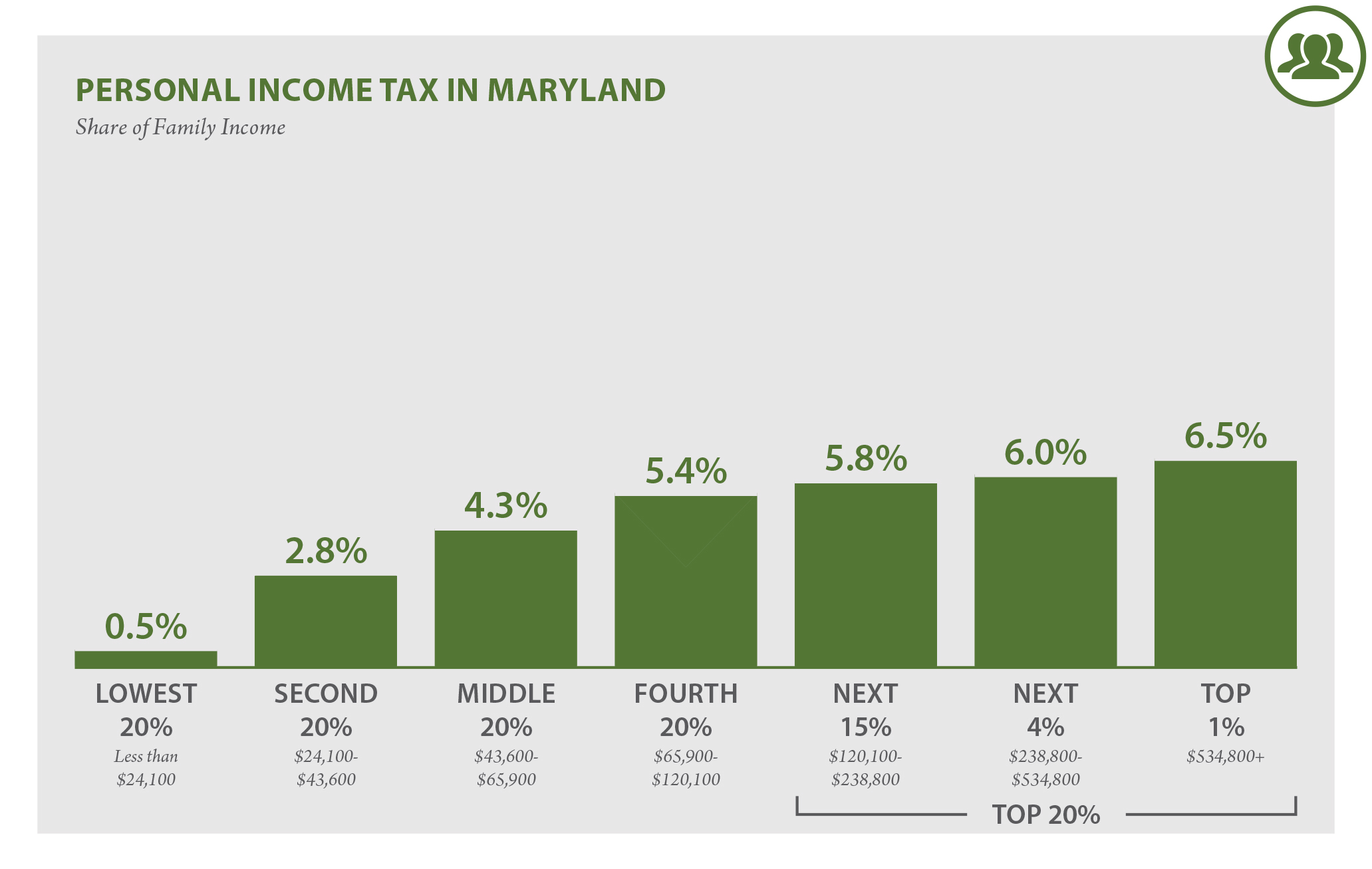

Maryland Who Pays 6th Edition Itep

What Can Maryland Do If I Owe Taxes

Maryland Relief Act What You Need To Know Mvls

Institute On Taxation Economic Policy Finds Maryland Asks More Of Low And Middle Income Taxpayers Still Ranks Maryland Highly Compared To Other States Maryland Center On Economic Policy

Maryland Who Pays 6th Edition Itep

Maryland Who Pays 6th Edition Itep

Filing Maryland State Taxes Things To Know Credit Karma Tax

Maryland Who Pays 6th Edition Itep

Maryland State 2022 Taxes Forbes Advisor

Maryland Vector State Of Usa In 2022 The Penny Hoarder How To Get Money Penny Hoarder

Tax Day Our Shared Investments In Maryland Maryland Center On Economic Policy

Governor Larry Hogan Official Website For The Governor Of Maryland